November Single-Family Home Sales Increase In Half of the Lower Hudson Valley Region

December 19, 2024

Median Sales Prices for Single-Family Homes Rise in All Sectors: Sullivan County Sees Highest Gain at Almost 20 Percent

(NOTE: Link to ALL regional reports: Market Data (hgar.com). Scroll down to 2024 Market Stats)

White Plains, NY

(December 2024) November sales of single-family homes increased in Westchester, Rockland, and the Bronx, with Rockland in the lead at 15.4% over last year at this time. Putnam, Orange, and Sullivan counties all experienced double-digit decreases in sales, with Orange seeing the largest decline at 19.5%.

Single-family median sales prices rose in almost all regions, with home prices in Sullivan County soaring by 19.6% to $357,500 – the largest gain in the region. Putnam County’s median prices remained the same as November of 2023 at $530,000

Orange County’s November condo sales experienced the highest gain at 36%, while Putnam condo sales increased by 18.2%, and the Bronx by 15.4%. Median sale prices for condos climbed everywhere but the Bronx, which saw a slight decline at 3%. Rockland County was the winner with a 16.2% hike in condo median prices at $430,000, as compared to last year at $370,000. Rockland’s co-op sales grew by 20%, and the median sales price by 43.9% to $161,200. Co-op sales declined in both Westchester and the Bronx.

Inventory for all property types declined in almost all areas, except for Rockland’s condo and co-op markets, the latter with an 84.6% gain. The Bronx led the region for new listings, with a 31.9% increase.

Today’s report by the Hudson Gateway Association of Realtors (HGAR) is based on data supplied by OneKey® MLS. “Sales and median prices of single-family homes continue to rise throughout most of our region, and we’ve also seen some substantial gains among other property types as well,” said HGAR CEO Lynda Fernandez. “I think the market indicates that we are poised to see more housing opportunities for more individuals and families in 2025.”

Bronx County

Closed sales of condos saw the largest increase at 15.4%, followed by single-family homes at 10.5%. November sales of the co-op market declined by 11.3%. Median sales prices rose by 7.2% for single-family homes bringing them up to $664,500 from $620,000 last year. Condos experienced a 3% hike to $325,000, while co-op prices rose 2.3% to a new median of $230,000.

The Bronx led the region with the number of new listings for single-family homes, up by 31.9% in November. Both the condo and co-op market listings declined by 25% and 16.7%, respectively. Inventory also declined for all three property types with condos seeing the largest drop at 35%. Inventory of single-family homes decreased by 15.7% and co-ops by 14.9%. Months of supply for all property types were down by 23% to 5.7 months while pending sales were up by 12.4%

Westchester County

October’s closed sales increased by 2.3% for single-family homes but declined by 15.5% for condos and 22.1% for co-ops. All three property types experienced gains in median sales prices, with condos leading the way at 9.6% to $525,000. Co-op prices moved forward by 8.4% to $227,701 and single-family home prices advanced by 4.7% to $890,000.

New listings were down for all three property types, with single-family homes at an 18.6% decline. Condo and co-op listings also decreased by 5.6% and 5.1%, respectively. Inventory decreased by 31.1% for single-family homes, followed by 10.6% for condos and 5% for co-ops. Months of supply for all property types was down 22.2% to 2.1 months, and pending sales were up by 4.2%.

Putnam County

While small, Putnam County’s co-op market saw an 18.2% increase in sales, from 11 last year to 13 this November. Single-family home sales, meanwhile, dropped by 18.6%. There were no co-op sales reported. Condos also saw a 5% growth in median sales prices to $315,000, while single-family home sales remained flat at $530,000 – the same as last year.

New listings for condos jumped by 10% while declining by 23.3% for single-family homes. Inventory for both property types decreased, with single-family homes by 14.5% and condos by 5.3%. Months of supply for all property types declined by 7.1% to 2.6 months. Pending sales dropped by 26.6%.

Rockland County

Co-op sales saw the highest increase in Rockland County at 20%, followed by single-family homes at 15.4% Only condo sales declined, by 12.8%. The co-op market also experienced the highest median price increase at 43.9% to $161,200 over $112,000 last November. The median price for condos also rose, by 16.2% to $430,000 and single-family homes by 7.3% to $755,000.

Both the condo and co-op markets saw an uptick in new listings at 27% and 25%, respectively. New listings for single-family homes fell by 8.3%. The co-op market was the winner again for inventory, soaring by 84.6%, and condos by 16.3% Conversely, the single-family market inventory took a downturn by 25.6%. Months of supply for all property types dropped by 19.4% to 2.5 months, but pending sales rose by 10.3%

Orange County

In Orange County, sales of condos grew by 36% in November, while single-family home sales declined by 19.5%. The co-op market, while small, did experience a 100% hike in sales from one last year to just two this November. Single-family median sales prices increased by 5.7% to $465,000 and condos by 2.5% to $289,500 Co-op prices decreased by 9.2% to $132,500 from $146,000 last year.

New listings declined for both condos and single-family homes at 6.7% and 1.7%, respectively. There was no change in new listings for co-ops. Condos saw a slight uptick in inventory at 1.4%, while single-family home inventory dropped by 10.8%. Co-op inventory remained flat. Months of supply for all property types was down 8.1% to 3.4 months, and pending sales decreased by 5%.

Sullivan County

While Sullivan County’s November sales fell by 18.3%, the county had the highest increase in median sales prices at 19.6% to $357,000, from just $299,000 last year. There were no condo or co-op sales reported.

New listings dipped slightly by 1.4%, but inventory of single-family homes increased by 5.7%. Months of supply advanced by 7.4% to 7.3 months. Pending sales increased by 10%.

The Hudson Gateway Association of REALTORS®

is a not-for-profit trade association consisting of over 13,000 real estate professionals doing business in Manhattan, the Bronx, Westchester, Putnam, Rockland, and Orange counties. It is the second largest REALTOR® Association in New York, and one of the largest in the country.

More Press Releases

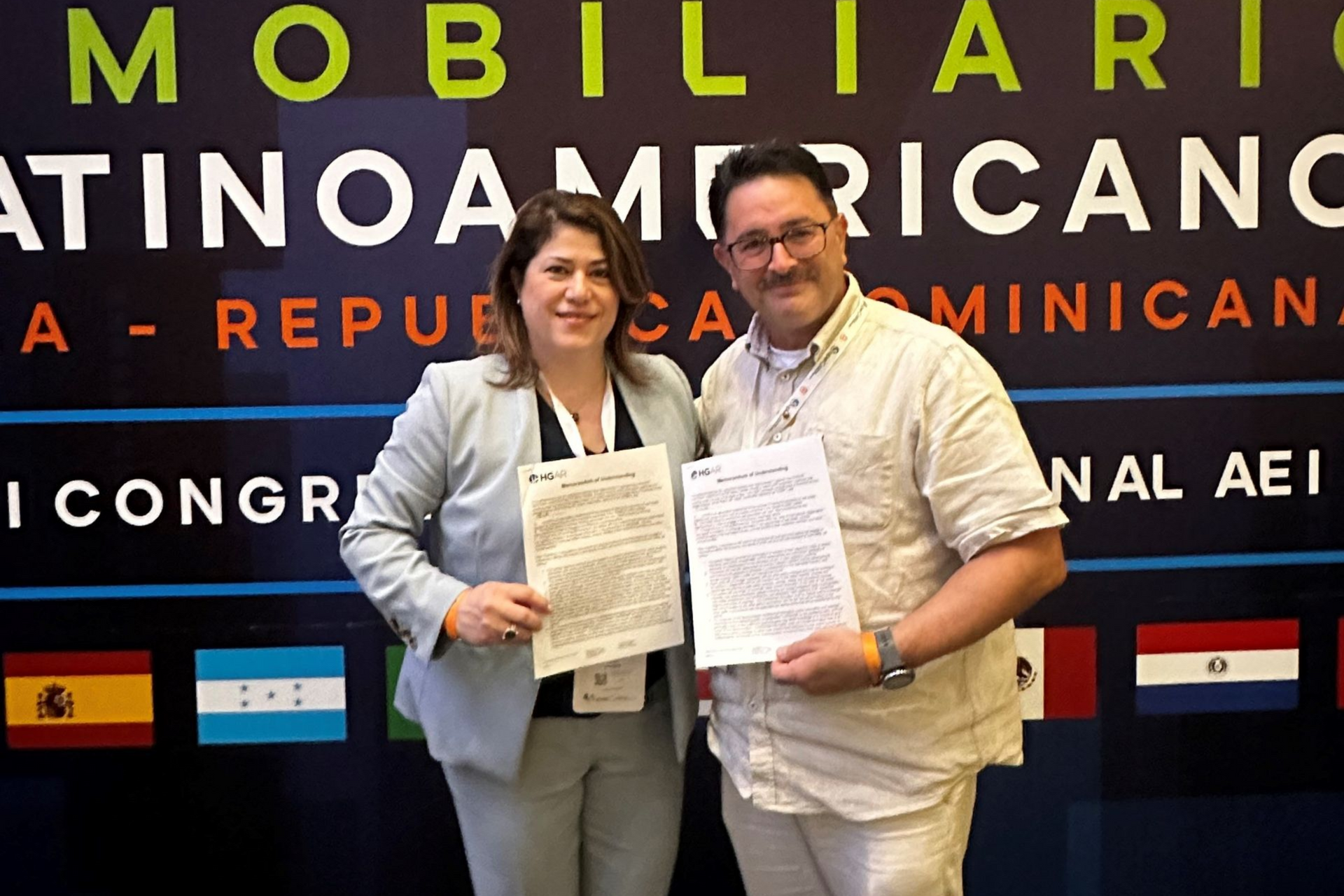

WHITE PLAINS, NY (September 2025) - The Hudson Gateway Association of REALTORS® (HGAR) continues to strengthen its global connections and open international business opportunities for its members through the signing of Memorandums of Understanding (MOU) with key real estate organizations worldwide. During the 10th Latin American Real Estate Congress and the 6th AEI International Congress, organized by CILA and AEI, in Punta Cana, Dominican Republic, HGAR signed a landmark MOU with Joao Araujo, BRANIB President and CILA President Enrique Morales, establishing a strategic partnership with the Confederación Inmobiliaria Latinoamericana (CILA). Through CILA, HGAR now connects with 18 real estate associations spanning across Latin America, creating a gateway to expanded markets, cultural exchange, and new global opportunities. CILA represents thousands of professionals from Argentina, Bolivia, Brazil, Chile, Colombia, Costa Rica, Cuba, El Salvador, Mexico, Panama, Paraguay, Peru, Uruguay, and beyond. This extensive network positions HGAR members to explore new opportunities for international collaboration, cross-border investment, and cultural exchange, while strengthening their role as trusted advisors in the global marketplace. “HGAR is proud to enter into this significant partnership with CILA, which strengthens our members’ ability to connect globally while expanding opportunities throughout Latin America,” said Lynda Ferandez, CEO of HGAR. “This collaboration underscores our commitment to ensuring REALTORS® in the Hudson Valley and beyond are positioned as leaders in the international marketplace.” The MOUs formalize each association’s cooperation in building mutually beneficial relationships for their members. HGAR currently has MOUs with 30+ associations and countries . Areas of collaboration include the sharing of market data, real estate practices, licensing and foreign investment laws, and professional development resources. Both organizations will also work to promote inbound and outbound investment opportunities, uphold ethical business practices, and foster participation in events, education, and networking exchanges. “Signing an MOU is more than a formality, it is a commitment that comes to life when our global partners actively connect and engage with HGAR members,” said Fernandez. “We look forward to continuing this momentum at our upcoming Global Real Estate Summit in New York City this November, where leaders from around the world will come together to share insights, strategies, and opportunities for cross-border business.” Learn more about HGAR’s global initiatives at Global Business Council | Hudson Gateway Association of REALTORS® and details on the Global Real Estate Summit here: https://www.globalresummit.com . ABOUT HGAR The Hudson Gateway Association of REALTORS® is a not-for-profit trade association representing 13,000 real estate professionals across Manhattan, the Bronx, Westchester, Putnam, Rockland, and Orange counties. HGAR is the second-largest REALTOR® association in New York and one of the largest in the nation.

WHITE PLAINS, NY (August 2025) - The Hudson Gateway Association of REALTORS® (HGAR) has released its July 2025 housing report, showing that the region’s real estate market remains resilient with continued price strength, even as inventory challenges persist. Data from OneKey® MLS shows a blend of rising prices, growing days on market, and stabilizing sales activity in several counties — highlighting the complexity of this post-pandemic housing environment. “Westchester continues to drive regional price trends, but we’re seeing interesting activity across our entire footprint,” said Lynda Fernandez, HGAR CEO. “In July, inventory saw small gains in some counties, but the market is still tight overall. While sales are slightly down in some places, prices are holding, indicating strong underlying demand. Buyers are adapting, expanding their options, and looking for value, while sellers are adjusting expectations and timelines.” Key Regional Trends Mortgage Rates: With 30-year mortgage rates averaging around 7% in July, many buyers remain cautious. Still, the Hudson Valley continues to attract those seeking space, value, and proximity to New York City. Shift in Buyer Behavior: Increased exploration of co-ops, condos, and townhomes continues, as affordability remains top of mind. Luxury vs. Entry-Level: Homes under $500,000 are still moving quickly, while higher-end properties are lingering longer and often require strategic pricing and staging. Inventory and Leverage: Inventory levels remain below the 6-9 months considered balanced. Markets like the Bronx, now at over 7 months of inventory, are offering buyers more negotiating room, while counties like Westchester and Rockland remain seller-favored. County Highlights Westchester County The median single-family home price hit $1,500,000 (+11% YoY). Closed sales were up 4%, while new listings dropped 6%. Days on market dropped to 18, down 5%, and months of inventory remained tight at 2.5. Condo prices rose 1%, co-ops 5%. Condos saw a decline in closed sales by 11% while co-op closed sales were up 2%. Putnam County Median price increased to $565K (+11%). Closed sales were up 16%. Inventory rose to 3.3 months, and days on market were up 4% to 26. Condo prices rose to $387K, up 9%. Rockland County Single-family median price: $765,000 (+17%). Closed sales were up slightly (+2%), but co-op sales dropped by 40%. Inventory sits at 3.2 months. New listings up 11%, but days on market dropped to 19 almost 10%. Orange County Median price reached $460,000 (+2.2%). Closed sales were up 4%. Inventory at 4.1 months with 405 new listings. Days on market rose to 31. Bronx County Median price rose to $468,000 (+9.5%). Co-ops remain in high demand, up 6.7% in median price. Closed sales were down 16%, and new listings dropped slightly by 1.7%. Inventory at 7.6 months offers more negotiating power for buyers. “With pricing trends holding firm and slight upticks in inventory, we’re seeing a transition — not a downturn,” Fernandez added. “Buyers who are prepared and realistic can find opportunities, and sellers should expect more measured activity. This is when professional guidance from a REALTOR® truly matters.” In today’s complex market, both buyers and sellers benefit from a strategic, informed approach. Buyers should be prepared with financing, stay flexible on location and property type, and act quickly on well-priced listings. Sellers should focus on competitive pricing and strong presentation, especially as higher-end homes spend more time on the market. Partnering with a knowledgeable REALTOR® is essential to navigating shifting conditions, uncovering opportunities, and making confident decisions. The full July 2025 housing report, including interactive charts and county-level data, is available at www.hgar.com/market-stats . ABOUT HGAR The Hudson Gateway Association of REALTORS® is a not-for-profit trade association representing 13,000 real estate professionals across Manhattan, the Bronx, Westchester, Putnam, Rockland, Orange, and Sullivan counties. HGAR is the second-largest REALTOR® association in New York and one of the largest in the nation.

WHITE PLAINS, NY (August 2025) - The Hudson Gateway Association of REALTORS® (HGAR) will host a pivotal panel discussion on Wednesday, August 6, 2025, bringing together city policymakers, housing advocates, legal experts, and real estate professionals to explore the role of housing vouchers in New York City’s rental market and the implications of the newly enacted FARE (Fair Access to Rental Enforcement) Act. The event, titled “Housing Vouchers: Challenges, Opportunities & the Fair Access to Rental Housing Act,” will take place at the Hutchinson Metro Center in the Bronx and will spotlight one of the most pressing and politically relevant housing topics affecting communities today. Event Details: Date: Wednesday, August 6, 2025 Time: 2:00 PM – 4:00 PM Location: Conference Room, Hutchinson Metro Center 1200 Waters Place, Bronx, NY 10461 Registration: Click here to register Admission: Free for HGAR members; $25 for non-members Panel Topics Include: • The real-world impact of housing vouchers in the Bronx and beyond • Common barriers to acceptance and access • The scope of the FARE Act • Strategies for housing professionals to better serve underserved communities “As the Director of Government Affairs for Manhattan and the Bronx, I believe it's critical that our members, and the public, stay informed and engaged on the policies that shape our housing landscape,” said Dr. Meadows. “This event is an opportunity for meaningful dialogue and action around affordability, access, and equity.” This forum will feature leading voices in housing policy and advocacy, including Emran Bhuiyan, Associate Broker & Director of Sales, Exit Realty Premium, Bronx-based landlord and small property owner; John Dolgetta, ESQ., Legal Counsel, HGAR, Managing Partner, Dolgetta Law, PLLC and Annerys Escarraman, Licensed Real Estate Agent, Keller Williams Realty NYC Group; a housing voucher expert with over 500 voucher transactions, and whose on-the-ground expertise and legislative insight are helping to shape the future of housing access in New York City. Their perspectives will provide critical context for REALTORS®, landlords, tenants, and community leaders navigating a complex and evolving rental landscape. ABOUT HGAR The Hudson Gateway Association of REALTORS® is a not-for-profit trade association representing 13,000 real estate professionals across Manhattan, the Bronx, Westchester, Putnam, Rockland, Orange, and Sullivan counties. HGAR is the second-largest REALTOR® association in New York and one of the largest in the nation.

The Hudson Gateway Association of REALTORS® (HGAR) has released its June 2025 housing report, revealing continued price growth and evolving inventory conditions across the Hudson Valley and surrounding areas. Based on data from OneKey® MLS, the report shows that while some areas are seeing increased options for buyers, prices remain high – especially in Westchester, which has crossed a historic threshold. “The median price of a single-family home in Westchester surpassed $1 million for the first time in 2025, reaching $1,200,000 up 14%, underscoring the region’s continued appeal despite affordability concerns,” said Lynda Fernandez, CEO of HGAR. “We’re also seeing double-digit price increases in Putnam and the Bronx, while sales activity remains strong in Rockland and Orange counties. Inventory is showing modest improvement in some areas, but it’s not keeping pace with demand — especially for move-in ready homes under $500,000. Buyers are shifting strategies, expanding their search radius, and exploring alternative property types. In this evolving market, REALTORS® are more important than ever in helping consumers adapt and succeed.” With 30-year mortgage rates hovering near 6.75% in June, buyers remain rate-sensitive, increasingly exploring townhomes, co-ops, and peripheral markets to stretch their purchasing power. Nationally, pending home sales in May rose 1.8% month-over-month and 1.1% year-over-year, according to NAR. Locally, HGAR’s region reflects similar resilience, with select counties such as Rockland and Orange posting strong sales growth despite affordability challenges. Market dynamics continue to reflect high competition at the entry level and slower movement in the luxury tier. Homes priced under $500,000 remain in high demand and have a short supply, leading to multiple offers and quick sales. Higher-priced homes, especially above $1 million in Westchester and Rockland, are seeing longer days on the market and more negotiation room. Inventory trends remain uneven, with some counties experiencing growth while others still face tight conditions. A balanced real estate market typically reflects 6 to 9 months of inventory — enough supply to meet demand without favoring buyers or sellers. Markets below that threshold, like most of HGAR’s region, continue to lean toward sellers, while areas approaching or exceeding that range, such as the Bronx, offer buyers more leverage and negotiating room. COUNTY HIGHLIGHTS Westchester County The median price for a single-family home hit $1,200,000 (+14%). Closed sales rose nearly 5%, showing that buyers remain engaged despite price pressures. Condo and co-op prices also rose 4% and 5.5% respectively, though sales dipped slightly. Days on the market in Westchester County dropped to just 19 in June, underscoring the continued competitiveness of the market. Inventory is also still constrained, with only 2.7 months of supply, down from last month. Sellers are well-positioned, especially with updated, move-in ready homes. There were 909 new listings in June, up slightly year-over-year. While Westchester remains a seller’s market, markets like the Bronx with 7.4 months are nearing balance, offering buyers more negotiating power. Putnam County Putnam’s single-family median price jumped to $612,000 (+10%), while closed sales dropped nearly 9%. Condo prices fell slightly (-3.3%), and sales dipped by 12.5%. With 3.6 months of inventory, buyers are gaining more leverage, though demand for move-in ready homes remains strong. There were only 127 new listings in Putnam, down nearly 9% year-over-year. Days on the market rose to 24, up 9%. Rockland County Single-family home prices rose to $785,000 (+5.4%), and sales climbed 7%. Condo prices held steady, but co-op prices dropped nearly 24%. Interestingly, co-op sales rose by 17%. With 3.6 months of supply, this market is becoming more balanced, offering buyers increased choices while maintaining seller momentum. There were 338 new listings in Rockland, up 10.5% Orange County Orange continues to attract value-driven buyers. The median single-family home price rose to $459,900 (+3.3%). While condo sales declined by 31%, prices remained stable. Inventory sits at 3.8 months. Orange remains a popular choice for first-time buyers and those priced out of neighboring counties. There were 416 new listings in June and days on the market were up nearly 4% at 28. Sullivan County The median single-family price rose to $351,500 (+2.6%), while closed sales fell nearly 8%. Known for its second-home market, Sullivan remains sensitive to mortgage rate fluctuations, but opportunities remain for buyers seeking seasonal properties or long-term investments. Bronx County In the Bronx, co-ops have become increasingly attractive to first-time buyers, contributing to a 15% year-over-year rise in median price, even as inventory builds. Bronx home prices climbed to $680,000, +8%. Closed sales declined by 15%, but new listings rose 12%, indicating a growing supply. Months of inventory for co-ops and condos alone rose to 9 months up 1.1% year-over-year. There were only 134 new listings in The Bronx, down 11%. Looking Ahead While prices remain strong, shifts in inventory and buyer behavior are creating a more nuanced market. Sellers should focus on presentation and pricing, while buyers can benefit from increased options and potentially more favorable contract terms. “Whether you’re buying or selling, it’s no longer just about speed, it’s about strategy,” Fernandez added. “Today’s market requires a more calculated approach. Buyers need to understand which areas offer the best value and be prepared with financing in place, while sellers must price competitively and ensure their homes stand out in a growing pool of listings. Navigating these complexities takes more than luck — it takes local insight, real-time market knowledge, and negotiation expertise. That’s where HGAR REALTORS® make the difference, helping clients make confident, informed decisions every step of the way.” The full June 2025 housing report, including interactive charts and county-level data, is available at https://www.hgar.com/news-stats/market-stats .

HGAR May 2025 Housing Report: Regional Market Stays Competitive as Prices Climb and Inventory Shifts

WHITE PLAINS—The Hudson Gateway Association of Realtors released its May 2025 housing market report on June 23, highlighting continued price growth across much of the Hudson Valley and surrounding counties, even as buyer activity and inventory trends vary from region to region. Based on data from OneKey MLS, the report shows a market where sellers still benefit from strong home values, while buyers are learning to move strategically amid affordability pressures, the report states. “The median price of a single-family home in Westchester rose to $999,000 in May, up 2% from a year ago, underscoring just how resilient demand remains,” said HGAR CEO Lynda Fernandez. “Sellers continue to benefit from tight inventory conditions, but buyers are adjusting by exploring more affordable areas or property types. This is where our Realtors bring critical value, helping both sides navigate an increasingly nuanced market.” Market conditions continue to vary widely depending on price point and property type. Entry-level homes under $500,000 remain in especially high demand across the region, with limited availability in many areas. As a result, buyers in this price range are facing stiff competition and often need to make swift, compelling offers. In contrast, properties priced above $1 million, particularly in Westchester and parts of Rockland counties, are seeing longer days on market and more room for negotiation. While overall inventory has increased in select counties, it is not evenly distributed, and the supply of turnkey, move-in-ready homes remains well below demand. While inventory remains tight in many parts of the region, the months of supply metric reveals early signs of easing in several counties. In May 2025: Westchester County : 2.8 months (+3.7%)—Still deeply in the seller’s market territory, keeping upward pressure on prices. Putnam County : 3.4 months (+17%)—Improved inventory gives buyers more options and negotiating power. Orange County : 3.9 months (+8.3%)—A balanced trend that may ease competition in this value-driven market Rockland County : 3.3 months (+18%)—Rising supply creates opportunities for buyers, especially in condos and co-ops. Bronx County : 8.6 months (condos, co-ops and townhomes) (+6.2%)—Now approaching a buyer’s market, offering greater flexibility and choice. For buyers, increased months of supply can mean more homes to choose from, less bidding pressure, and more favorable contract terms. For sellers, especially in markets with rising supply, it underscores the importance of competitive pricing and home presentation to stand out. Realtors play a critical role in guiding buyers and sellers through these shifts with expert insight and strategy, HGAR officials state. Bronx County Home prices in the Bronx continued to climb, up more than 10% to a median of $667,000. While closed sales declined 17%, a surge in new listings (+18%) and growing inventory (now at 7.5 months of supply for all property types) means buyers have more homes to choose from. Sellers should still expect demand, especially for well-priced homes, but may face more competition from neighboring listings. Westchester County Westchester remains the region’s most competitive market. The median single-family price reached $999,000, up 2%. Closed sales rose 7.4%, showing buyers are still motivated despite higher prices. However, closed sales for condos and co-ops declined even as their prices increased. Sellers are in a strong position, especially those with homes in move-in condition, but buyers will need to act fast and come prepared. Putnam County Putnam saw home prices rise to $595,000 (+4.6%), but sales dropped by 18%. Condo prices fell by nearly 15%, with sales plunging by nearly 60%. The upside for buyers is greater choice, inventory has more than doubled. Sellers should be flexible with pricing and expect a longer time on the market. Rockland County Rockland saw a slight dip in single-family prices (down 4% to $750,000), while condo and co-op prices dropped 5% and 36% respectively. Yet, condo sales jumped 33% and co-op sales surged 50%. With inventory rising by over 40%, buyers are seeing more opportunities and slightly less competition. Orange County Orange County continues to attract buyers looking for value. Single-family prices remained steady at $450,000, and sales rose by 2%. Condo prices rose 2%, though sales dropped nearly 55%. Co-op sales dipped sharply, but prices climbed by 57%. This affordability is attracting first-time and mid-range buyers, making it a prime area for sellers to list. Sullivan County In Sullivan, the median price for single-family homes climbed 7% to $342,500, while sales slipped slightly (-6.5%). This market, popular for second homes, remains sensitive to interest rates. Buyers may find opportunities to negotiate, while well-maintained homes continue to draw interest from seasonal and investment buyers. Market Observations Across the board, the May 2025 data shows that while inventory is starting to improve in some areas, prices remain elevated due to continued demand. Buyers should secure financing early and work closely with experienced Realtors to navigate the market and find the right opportunities. Sellers, meanwhile, should take advantage of strong pricing trends but ensure homes are well-prepared and competitively priced to stand out. “Buyers are adapting to higher interest rates by looking at more affordable markets and property types,” HGAR’s Fernandez added. “Meanwhile, sellers are still benefiting from solid price growth. This market rewards preparation and local expertise, our Realtors are ready to help buyers and sellers make informed decisions.” The full May 2025 housing report, including interactive charts and local data, is available at Market Data | Hudson Gateway Association of REALTORS® .

WHITE PLAINS, NY (June 2025) – The Hudson Gateway Association of REALTORS® (HGAR) has named Dr. Jermaine Meadows as its new Director of Government Affairs for the Bronx. In this role, Dr. Meadows will advocate for housing policies that support equitable growth, affordability, and sustainable development throughout the borough. Dr. Meadows brings a robust background in public policy, government relations, and community advocacy. He began his career in Albany with District Council 37, gaining a unique perspective on labor and legislative collaboration. Most recently, he served as Associate Director for Local Government Affairs at Everytown for Gun Safety, where he led initiatives that secured millions in funding for gun violence prevention across the country. “We are thrilled to welcome Dr. Meadows to HGAR,” said Lynda Fernandez, Chief Executive Officer of HGAR. “Having a dedicated government affairs professional focused solely on the Bronx is a critical step in addressing the unique and complex housing challenges facing the borough - from the ongoing inventory crisis to the need for greater co-op transparency, and the evolving legislative landscape surrounding Good Cause Eviction and more. Dr. Meadows' presence ensures that our members have a strong advocate who understands both the policy and the people. His work will not only help advance fair housing goals but also create meaningful opportunities for our REALTOR® members to better serve their communities.” With a Doctor of Education in Leadership and Learning in Organizations from Vanderbilt University, Dr. Meadows has long focused on using policy as a lever for meaningful community change. At HGAR, he will work to foster stronger relationships between REALTORS® and lawmakers while championing housing policies that reflect the needs of Bronx residents and the real estate community. Dr. Meadows also founded The Neighborhood Role Model LLC, an initiative focused on reducing mental health disparities in underserved communities. “I’m honored to join HGAR and bring my legislative experience and policy expertise to a role that directly serves the Bronx, a community I care deeply about,” said Dr. Meadows. “This position is an opportunity to advocate for practical, inclusive solutions to some of the region’s most pressing housing challenges, such as the evolving landlord-tenant laws. I look forward to building strong partnerships with our REALTOR® members and local officials to promote fair housing and expand opportunities for sustainable business growth.” The Hudson Gateway Association of REALTORS® is a not-for-profit trade association consisting of over 13,000 real estate professionals doing business in Manhattan, the Bronx, Westchester, Putnam, Rockland, and Orange counties. It is the second largest REALTOR® Association in New York, and one of the largest in the country.